STATE REVENUE COMMITTEE OF THE

MINISTRY OF FINANCE OF THE REPUBLIC OF KAZAKHSTAN

PRESS RELEASE

Tax amnesty in the Republic of Kazakhstan – do not miss the opportunity

As it known, on instructions from the First President of the Republic of Kazakhstan in the country is held tax amnesty for small and medium business on writing off penalties and fines subject to the repayment of the principal amount of the tax.

On 20 May, 2019 in total in the Republic 37,150 taxpayers for a total amount of 7.3 billion tenge were repaid their tax arrears, they are subject to write-off of penalties in the amount of 1.9 billion tenge and fines of 98.7 million tenge.

It should be noted that on 1 October 2018 in the Republic 90,077 subjects of small and medium business had outstanding tax arrears, the amount of arrears of which amounted to 210.4 billion tenge, penalties - 122.9 billion tenge, fines - 7.4 billion tenge.

We call attention that the tax amnesty will last until the end of this year, in connection with which we remind small and medium-sized businesses of the opportunity to get rid of their accumulated debts and cancel all restrictions imposed by the state revenue authorities.

In addition, we inform taxpayers - individuals about the upcoming tax amnesty by writing off a penalty subject to the payment by the individual of the principal amount of tax on tax liabilities for tax periods before January 1, 2019.

Corresponding amendments to the tax legislation are currently under consideration in the Mazhilis of Parliament.

In case of adoption of the amendments, under the amnesty will fall 1 390.0 thousand people, whom subject to payment of arrears in the amount of 13.9 billion tenge, penalties will be written off for a total of 7.0 billion tenge.

The second block of seminar questions is connected with some aspects of conducting of office control.

In accordance with Article 96 of the Tax Code, in case of disagreement with the violations indicated in the notification, the taxpayer provides clarification on the identified violations on paper and electronic media, however, there are a number of circumstances where these explanations cannot be presented, as well as special attention will be paid the question of the timing of the recognition of the notice not executed and further appeal against the decision on the recognition of the notice not executed.

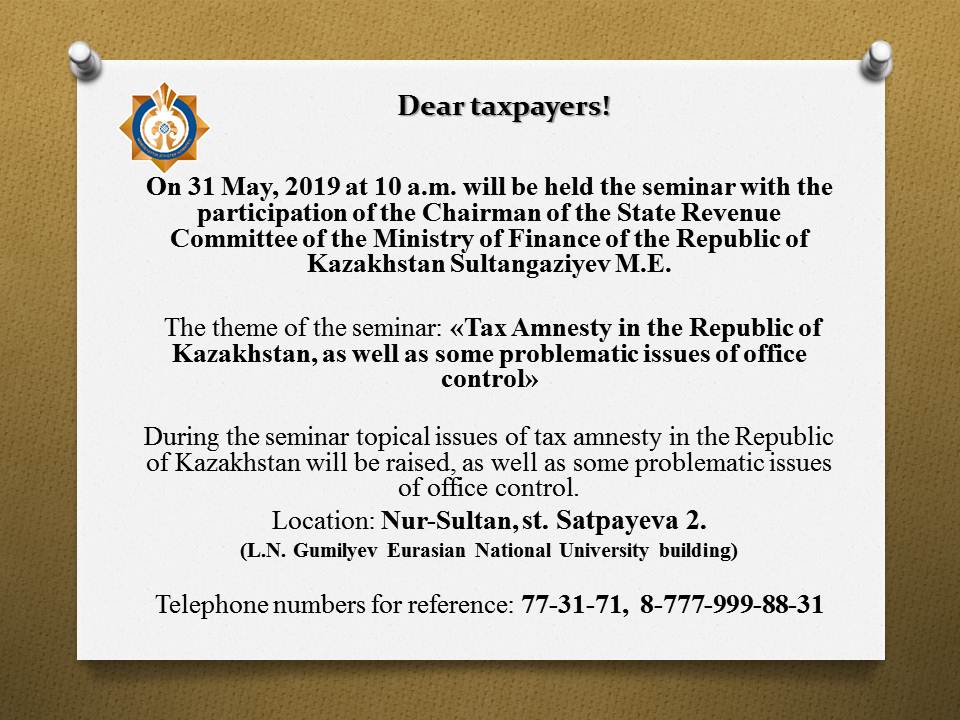

On 31 May, 2019 at 10-00 am, a seminar for taxpayers will be held with the participation of the Chairman of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan, M. E. Sultangaziyev.

During the seminar topical issues of tax amnesty in the Republic of Kazakhstan will be raised, as well as some problematic issues of office control.

Press-office

State Revenue Committee

Ministry of Finance of the RK

(Zhenis avenue, 11)